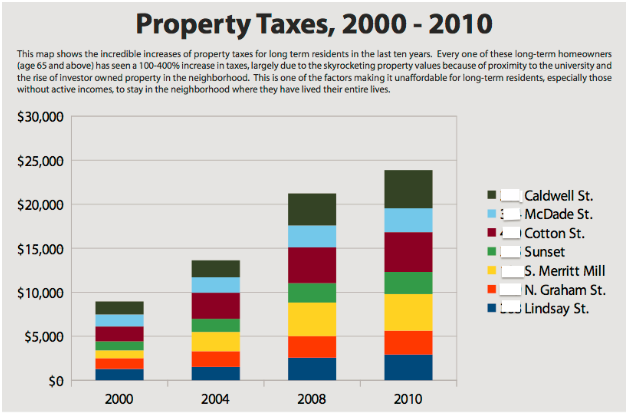

For the last fifteen years or more, Northside neighbors, many of whom have lived here for decades, have faced rapidly increasing property taxes, making it increasingly difficult for long-term neighbors to stay rooted in our community. This year, the Jackson Center offered its first year of small grants to assist with property taxes for aging, long-term, low-moderate income households in Northside. The goal of this program is to help neighbors stay rooted in this community. This year, we were able to provide support for 18 households in Northside, with an average age of 77, average stay in the neighborhood of 56 years, and average property tax burden of 12%!

Is this program happening again?

These limited funds will be available in 2017 too. This Property Tax Relief Program prioritizes our elderly neighbors, who are mostly on a fixed income, and who are still facing a burden even if they qualify for and receive current relief strategies such as the Homestead Exemption and Circuit Breaker. But we encourage you to talk with us even if you do not meet the priority areas but are struggling to maintain your property taxes. We assist residents with County Tax Program applications as well!

Eligibility* (for our program – different restrictions apply for the County tax programs):

- Homeowners in Northside (including historic Pottersfield, Sunset, and Lloyd/Broad) with a household income less than or equal to (< or =) 80% Area Median Income, defined as the following:

- For a household of one, less than or equal to $39,600 per year.

- For a household of two, less than or equal to $45,250 per year.

- For a household of three, less than or equal to $50,900 per year.

- For a household of four, less than or equal to $56,550 per year.

- All applicants will need to have participated in or hosted a “Keeping Your House a Home: Preservation Tools” discussion. This 1.5-hour interactive workshop, developed by neighborhood leaders and civil rights attorneys, shares many additional tools and resources that can keep a house a home: property tax resources, home repair programs, legal and financial tools to help ensure the future you want for your home. There may be other ways to further reduce your house costs or property tax burden, and we want to make sure these resources are shared widely (and hope you will share additional ones you know about too). Click here to learn more about this workshop.

Priority Households (Limited funds available, attention will be given to the following first):

- At least one homeowner 62 years of age or older and/or disabled.

- Homes in which at least one member of the household has lived here more than 10 years.

- Homeowners at a lower income or paying a large percentage of income to property taxes.

- Property taxes are current or on a payment plan. If you need help catching up on back taxes, please contact the Jackson Center to discuss options.

Estimated Range of Assistance: ~$300-$1000 per household.

Application: Here is the link to last year’s application. Next year’s will be available by August. Call us if you are interested in receiving the application by mail. *If you are in need and miss the application window, please contact the Jackson Center.

2019 Property Tax Relief

2019 Property Tax Relief Application